The United States has long been the financial capital of the world and it’s about to lose that crown, unless it gets its act together.

After all, finance is about money, and money is measured by currencies and the US has not been able to take a lead on the global currency of the future. Of course, I am not talking about Dollars, Euros, or even Yuan, it’s all about Cryptos.

Some time back, United States’ regulatory body, SEC, filed a lawsuit against Ripple (XRP) for having conducted an “unregistered securities offering” with the claim that XRP is a security, and the sale should have been registered. Ripple’s argument is that XRP is a tool that facilitates international payments rather than an unregistered investment product and that the agency’s jurisdiction does not extend to the token and its sales. If XRP loses, then crypto companies in the US will have to go through the same legal rigors as securities to launch. While it might help protect investors, it would probably crush the industry domestically.

In 2020, Uniswap, a decentralized exchange (DEX) 2020, sent a large portion of its governance token allocation to people who had previously used the service. It required no investment from users, nor was there an ‘expectation of future profits,’ thus wasn’t classified as a security. Profits to token holders don’t come from any business entity. You can buy these tokens (like shares), earn profits (like dividends) but the way it has evolved, completely circumvents the law. If S.E.C. wanted to, who will they sue? There’s no single entity controlling operations, the entire thing is a piece of code on the Ethereum network.

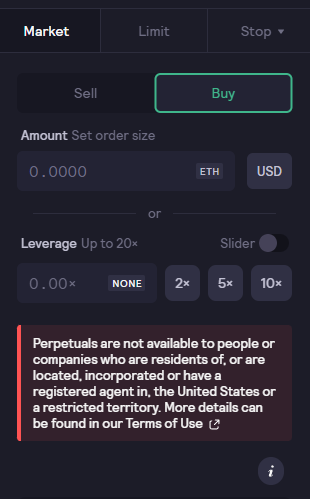

Ripple’s case has sent ripples (no pun) around the world. An interesting case is the derivatives exchange dYdX that is decentralized like Uniswap but has made its entire protocol and APIs inaccessible to US residents to protect itself from any legal liability. While the company behind this is still in control but when the protocol is fully decentralized, there will not be a way to turn the access off.

Mirror protocol is another interesting platform by Terraform Labs, incorporated in Singapore. On an operations level, Terraform Labs and its founders have zero involvement with the USA, however since Mirror protocol allows collaterals (such as shares traded on a US exchange) to create synthetic assets, SEC decided to sue the founders of Terraform.

There is hope, of course. Recently U.S officials have shown a particular interest in regulations including Biden’s latest executive order including wanting to explore a digital version of the dollar. We are far from the stage of cryptocurrency being the primary currency of the digital economy and it will have to go through the whole fear, uncertainty and doubt phase, followed by cautious optimism and then frantic adoption.